Table of Contents

Throughout the world, businesses of every size are feeling firsthand the impacts of instability. In a time of uncertainty, surviving and thriving comes down to how promptly your business can identify disruptive changes and proactively respond to them.

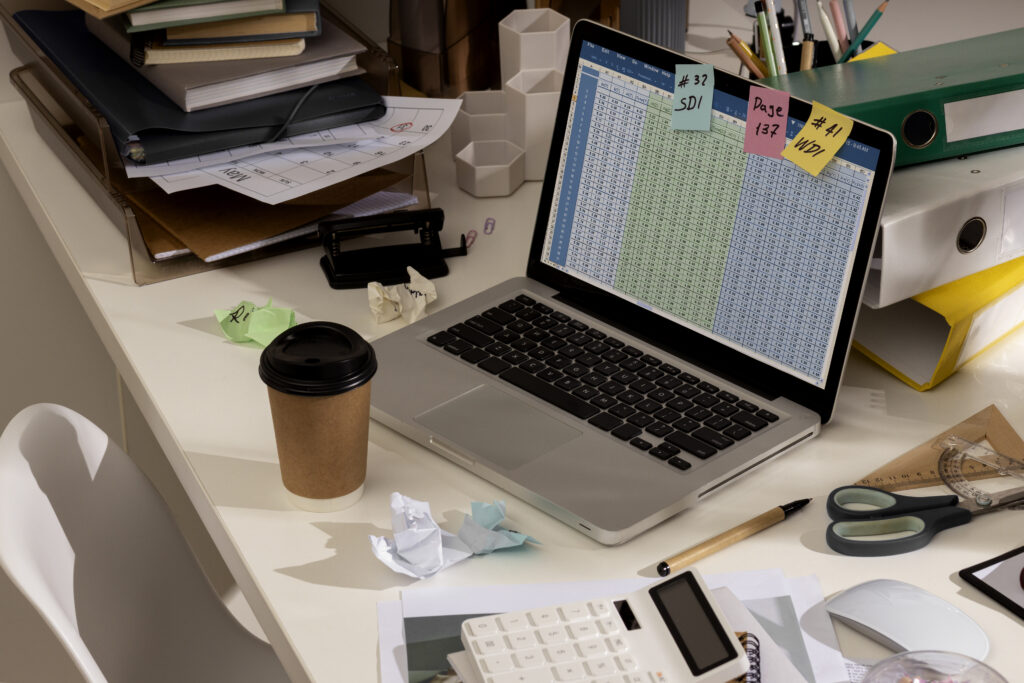

That’s not so easy when your business is mired in static planning—characterized by long planning cycles, immediately obsolete plans, siloed efforts, and hard-to-find errors. Manual, spreadsheet-based planning, budgeting, and forecasting may have worked well enough in a more predictable age. But as we’re discovering, that age is long gone.

Practical Steps for Business Agility

Even traditional market forces have proven challenging. Technological advances, ever-increasing customer expectations, and smarter, data-driven decision-making put pressure on finance teams to find new ways to operate with agility.

But how do you plan in a way that allows you to respond to such events, from the predictable to the unlikely?

The answer begins—and ends—with active planning.

Why static planning is a disadvantage

The static, traditional planning models finance teams relied on for decades aren’t just a questionable choice in times of disruption—they can leave your business at a grave disadvantage. Businesses hampered by outdated planning processes are often left scrambling to react to changes while more agile competitors outpace, outperform, and outmanoeuvre them. Look around you: The companies that are performing well at this minute have pivoted—sometimes substantially—in a matter of weeks, sometimes days. Their business agility has become their defining attribute for success.

It’s safe to conclude that many of these agile businesses aren’t weighed down by manual, episodic, and siloed planning. Rather, they’ve likely embraced a more modern approach to planning—planning that’s collaborative, comprehensive, and continuous. These businesses consistently minimize risk, maximize performance, and create competitive advantages because their planning empowers greater business agility.

The difference between static and modern—or active—planning can be stark. Legacy planning tools are typically bogged down by versioning headaches and siloed, instantly perishable data. In contrast, active planning models allow teams to broaden planning data beyond finance, pulling in real-time operational and transactional data from ERP, HCM, and other slices of the enterprise stack—all to make better, data-driven decisions quickly.

Laying the groundwork for business agility

As many companies recognised even before the current crisis, agility is a business imperative—and this more modern approach to planning is the key to achieving it. These three milestones will get you started on your journey to achieving an active planning model.

Assess the status quo

Before you map out where you’re going, you need to understand where you are. Take inventory of the current state of your company, more specifically the business planning obstacles keeping you from implementing a more modern and streamlined planning environment. More than likely, these obstacles will pertain to people, processes, or technology, or some combination thereof.

Assessing where you are means getting granular.

- What do your current business planning processes look like?

- How long does it take you to create a budget? A forecast? An annual plan?

- Where are opportunities for improvement?

- Who are your planning stakeholders?

- What technology do you have in place, and how well is it serving you?

- What data challenges need attention?

- What are the bottlenecks?

- What could be automated that isn’t?

- Are there any opportunities for automated data integration?

- What are you lacking in workforce planning?

Answering questions like these will help you get a clear sense of what you’re working with and where you can improve.

Get organisational alignment

Being a change agent is no easy task. That’s why you’ll need to recruit a savvy senior-level advocate to help champion active planning as a worthy and necessary cause. Along with your senior advisor, you’ll need a task force representative of other departments outside of finance, including operations, sales, and HR. Don’t forget to include IT to help you navigate technology needs and coordinate various data sources.

The next move is to align these key people with the business agility cause you’re championing.

How? Build a business case.

You can do this by quantifying the impact that the organisation’s current status quo has on the company. What are manual processes and bottlenecks costing your business in time and money? What opportunities are passing you by? Conversely, what would those measurement strategies and KPI models look like if you implemented an active planning model? Try to unearth more nuanced ROI measures—for instance, how cutting budget time in half could give your people more time to run critical what-if scenarios—to really drive home the meaningful change that a modern agility planning model would bring.

Once your team is in place and your pain points recognised and quantified, you can map out a plan for your initial project. Consider focusing your initial effort on a function within finance so you’ll have control over the rollout. Develop a multi-phased plan that clearly communicates goals (both for implementing active planning and for this inaugural project), a concise and actionable plan, and the key metrics for your KPI model. The ability to effectively communicate the why behind this initiative will help secure any executive buy-in you need for the how. A comprehensive and well-thought out plan will go a long way toward achieving that.

Expand across the business

As noted above, there’s a strong case for beginning the rollout of your active planning model in finance and focusing on low-hanging fruit to bring early and easy wins. You’re motoring along, mapping projects, tracking and communicating progress, analysing KPI reports, and making necessary tweaks. Once a rhythm and familiarity are in place, broaden your scope beyond finance. Initiate planning projects that engage HR, sales, or marketing. This is where you begin to extend the use and impact of active planning company-wide.

The key in this phase is to strengthen cross-departmental communication and collaboration. Don’t fall into the trap of relying on your technology or tools to do the heavy lifting. It will be easier to realize and maintain success with regular stakeholder one-on-ones, identifying lessons learned along the way, uncovering opportunities for more ingenuity and improvement, and communicating success and congratulations when they’re warranted.

Doing this will help elevate the role of finance to a strategic force within your organization by orchestrating planning throughout the business. Finance will no longer be known primarily for gathering budget numbers and issuing reports. Instead, your business will look to finance to drive the change and innovation needed to not only weather times of uncertainty, but to thrive in them.

Map your way forward

These three pillars lay the groundwork for creating a more agile planning environment—one that will help you plan for what’s coming, whatever that may be. But since it’s merely a foundation, you’ll want to build on it. Stay tuned for additional insights that can help you derive even greater value from your modern planning environment.

Because the only thing certain about the future is that it will reward business agility. With this foundation and the insights we’ll share in subsequent blogs, you’ll be much better equipped to map your way forward into that tomorrow.