Table of Contents

In the dynamic world of corporate finance, planning isn’t just about forecasting; it’s about enabling organisations to adapt and thrive in the face of change. Enter continuous planning—a forward-thinking approach that empowers businesses to navigate uncertainty with agility, precision, and confidence.

Gone are the days when static, annual budgets were the cornerstone of financial planning. Much like how smartphones transformed communication with real-time updates, continuous planning has revolutionised the finance landscape. By integrating always-up-to-date data, iterative forecasts, and scenario-based analysis, this approach positions businesses to respond proactively to disruptions rather than reacting to them.

The Pillars of Continuous Planning

For organisations aiming to transition from legacy processes to a more adaptive planning model, three foundational elements stand out: processes, people, and technology. Together, these pillars drive the transformation needed to unlock the full potential of continuous planning.

1. Agile Processes: The Blueprint for Transformation

Agile processes form the backbone of continuous planning. These frameworks enable finance teams to move away from labour-intensive spreadsheets and static reports, embracing methodologies prioritising responsiveness and integration. Three key process types stand out:

Rolling Forecasts:

Unlike traditional forecasts that rely on static assumptions, rolling forecasts offer a dynamic view of financial performance. By continuously updating predictions based on current data, finance teams can respond to shifting market conditions—be it fluctuating revenues or emerging competition. This ensures decisions are grounded in reality rather than outdated projections.

Scenario Analysis:

In a world full of uncertainties, what-if scenario planning is an indispensable tool. By modelling various potential outcomes, organisations can evaluate the impact of strategic choices and prepare for challenges ahead. This proactive approach minimises risk, empowering businesses to capitalise on favourable conditions and mitigate negative impacts.

Driver-Based Planning:

A step beyond traditional budgeting, driver-based planning emphasises cross-functional collaboration. Focusing on key performance drivers—such as sales volume or customer acquisition costs—ensures that budgets align with overarching business objectives. This holistic view of performance helps organisations remain agile while ensuring resources are allocated effectively.

2. Skilled Teams: The Human Element of Continuous Planning

Processes alone cannot drive transformation without the right talent. Finance professionals must evolve from number crunchers to strategic advisors. Continuous planning demands individuals skilled in data analysis, scenario modelling, and collaborative decision-making. Equally important is fostering a culture of adaptability, where teams are empowered to embrace change and continuously refine strategies.

3. Advanced Technology: The Enabler of Agility

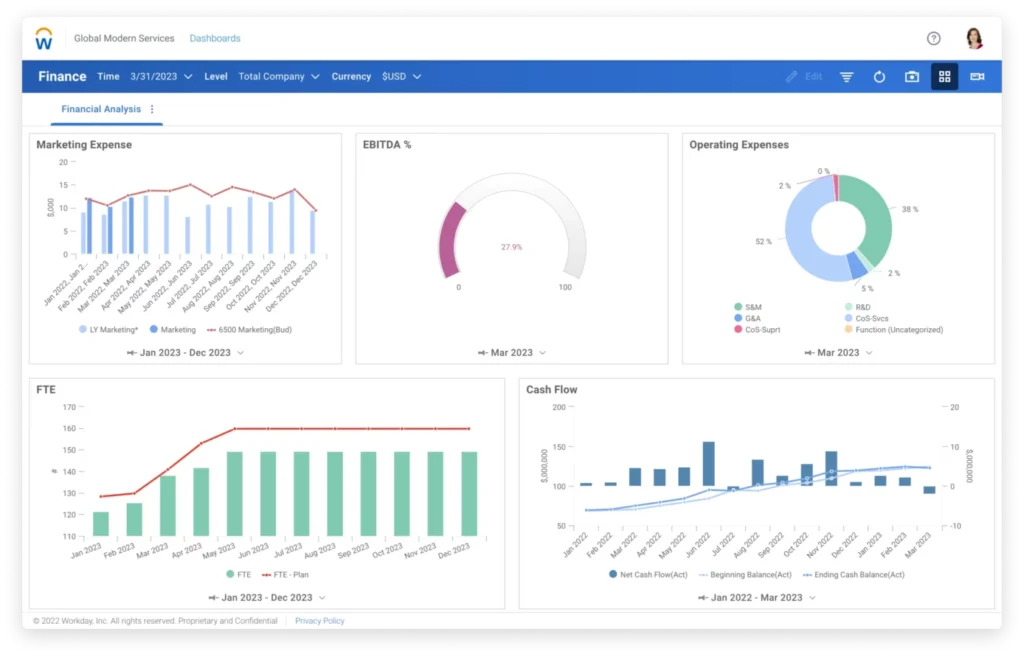

No continuous planning environment can thrive without robust technological support. Modern finance teams rely on integrated platforms to consolidate data, perform real-time analysis, and generate actionable insights. These tools break down silos, providing organisation-wide visibility that ensures every department operates with a shared understanding of business priorities.

From automating repetitive tasks to delivering predictive analytics, technology serves as the engine that drives agility and scalability in financial planning.

Building a Culture of Continuous Planning

Creating a successful continuous planning framework extends beyond processes, people, and tools. It requires a cultural shift. Leaders must champion the value of real-time adaptability, promoting a mindset that prioritises agility over rigidity. By embedding continuous planning into the organisation’s DNA, businesses can foster resilience and innovation at every level.

This cultural evolution isn’t just about reacting to challenges—it’s about embracing opportunities. By viewing planning as an ongoing, collaborative effort rather than a periodic exercise, organisations position themselves to lead, innovate, and grow in an ever-changing landscape.

Why Continuous Planning Matters Today

In today’s volatile economic environment, agility is no longer optional—it’s a competitive advantage. Continuous planning empowers businesses to pivot quickly, make informed decisions, and drive sustainable growth. Through rolling forecasts, scenario analysis, and driver-based strategies, finance leaders can align short-term tactics with long-term goals, ensuring resilience in an uncertain future.

For those ready to embrace this transformation, the payoff is clear: better insights, faster decisions, and a business that thrives under pressure.

Begin with pivotal insights, explore the power of technology from the latest innovations in business planning and network with industry leaders as they delve into the latest trends of financial planning.

See how Workday Adaptive Planning’s intelligent financial tool empowers your finance team and drives business growth for success. Click to learn more